Read time 5 min

Read time 5 minCommon Area Maintenance (CAM) charges are an important yet complicated aspect of commercial leasing. Covering expenses like maintenance, security, and utilities, these charges often lack transparency, leading to unexpected costs and budgeting challenges.

A clear understanding of CAM charges and their impact on your lease can help avoid disputes and manage expenses effectively.

In this blog, we’ll break down CAM components and understand CAM charges with Springbord’s expertise guiding you through the complexities.

The Complexity of CAM Charges in Commercial Leasing

Common Area Maintenance (CAM) charges can be an essential and often confusing expense for business owners in commercial leases. Covering costs such as maintenance, security, and utilities, these charges can greatly impact profitability.

However, a lack of transparency in how CAM charges are calculated often leads to unexpected expenses. According to a JLL study, 74% of tenants are concerned about the lack of detailed breakdowns in CAM invoices, resulting in budgeting challenges and disputes.

To avoid costly errors, it’s essential for business owners to thoroughly understand their lease agreements, especially the specifics of CAM charges. Expertise in lease auditing, like that offered by Springbord, can help ensure transparency and fair billing practices.

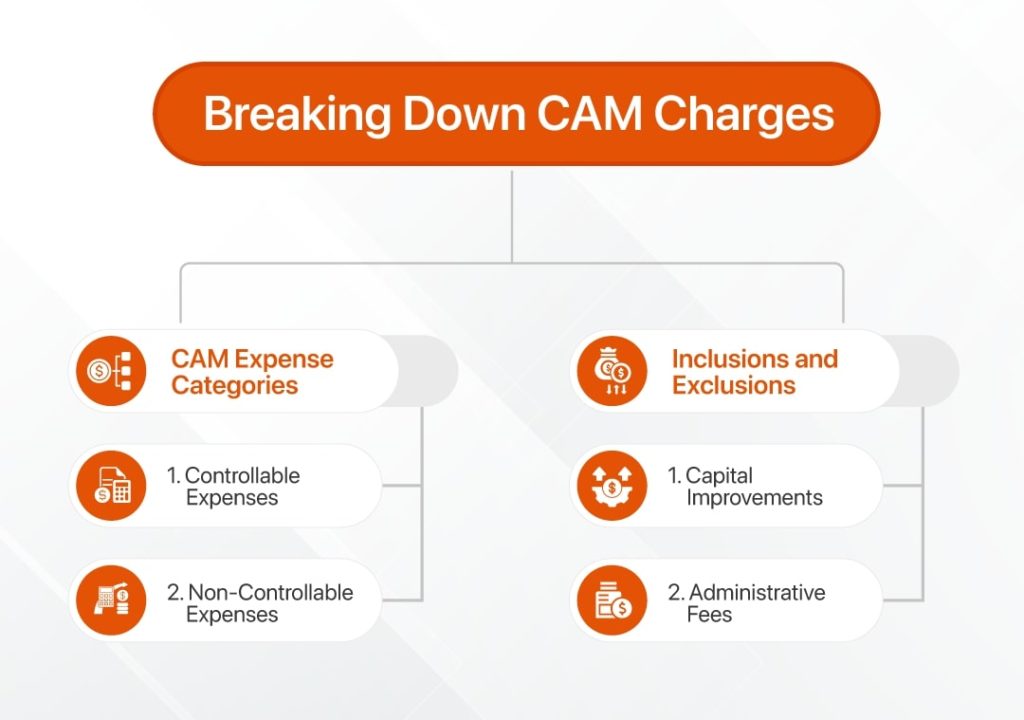

Breaking Down CAM Charges

Common Area Maintenance (CAM) charges encompass a range of expenses related to the upkeep of shared spaces within a commercial property. Typically, these include maintenance, repairs, landscaping, security, utilities, and snow removal.

Some leases might even include administrative fees associated with managing these services. Tenants must have a clear understanding of the scope of common area maintenance (CAM) charges, which vary significantly depending on the terms of the lease, the size of the property, and the extent of shared areas.

A recent CBRE report indicates that CAM charges can account for up to 15% of the total lease costs, highlighting their impact on a business’s operating budget. Failure to accurately account for these charges can lead to unexpected financial strain and disputes between landlords and tenants.

CAM Expense Categories

CAM expenses fall into two main categories:

- Controllable Expenses: These are costs that landlords can manage or limit, such as landscaping, janitorial services, and building maintenance. These costs are often subject to negotiation for capping annual increases to prevent excessive fluctuations. For instance, landlords may agree to a cap of 5% annually on controllable expenses, offering tenants better cost predictability.

- Non-Controllable Expenses: These include costs that are beyond the landlord’s direct control, such as property taxes, insurance, and utility costs. Non-controllable expenses are typically passed through to tenants in full, often without caps on increases. Understanding this distinction is crucial for tenants to identify areas where negotiation can help manage their expenses.

Inclusions and Exclusions

CAM charges usually include various costs, such as parking lot upkeep, lobby cleaning, snow removal, and property insurance. Tenants, however, need to be aware of any exclusions that might have an impact on their expenses. Common exclusions might involve:

- Capital Improvements: Costs for significant upgrades or renovations that generally benefit the property in the long term should not fall under CAM. Tenants should ensure their lease specifies that capital improvements are excluded unless they directly reduce operating expenses (e.g., energy-efficient upgrades).

- Administrative Fees: Excessive administrative fees or management costs should be scrutinized, as these can often be inflated or not directly related to CAM.

Given the complex nature of these charges, professional support in CAM reconciliation and lease auditing, like that offered by, Springbord, can ensure tenants are not overpaying and that they clearly understand the expenses they are responsible for.

Lease Types and Their Impact on CAM

- Triple Net (NNN) Leases: In NNN leases, tenants are responsible for a proportional share of CAM charges in addition to rent. These charges are often calculated based on the tenant’s leased space relative to the entire property. For example, a tenant occupying 25% of a building would typically pay 25% of the total CAM expenses. NNN leases provide landlords with cost recovery while giving tenants transparency on shared expenses. However, tenants must meticulously review CAM clauses to avoid unexpected charges.

- Modified Gross Leases: With modified gross leases, tenants pay a base rent that may include some CAM expenses, while others are billed separately. This structure requires clear negotiation on which costs are covered and which aren’t. For instance, tenants may negotiate to exclude certain expenses, like common area utilities, ensuring more predictable costs.

- Gross Leases: In gross leases, CAM charges are often built into the overall rent, reducing the variability of expenses for tenants. Landlords typically cover all operating costs, making it easier for tenants to budget. However, tenants should be cautious, as landlords might set a higher base rent to offset potential increases in CAM expenses over time.

Tenants who are aware of how various lease arrangements impact CAM charges will be better able to negotiate favorable terms and manage their money. Springbord’s lease abstraction and audit services can help business owners review lease terms, ensuring transparency and compliance with negotiated agreements and safeguarding them from unwarranted charges.

Recent Trends Impacting CAM Charges

A significant trend influencing CAM charges is the shift toward sustainability initiatives. Property owners are investing in green building practices like energy-efficient lighting and eco-friendly landscaping. While these measures offer long-term benefits, they can increase CAM costs in the short term. According to the U.S. Green Building Council, green buildings can reduce energy consumption by 20–50%, but the initial expenses may be passed on to tenants.

Smart building technologies are another trend affecting CAM charges. These technologies enhance operational efficiency but introduce new costs for software and system upgrades. A report by NAIOP states that 65% of commercial property owners now use smart building technologies, which will impact future CAM expenses.

Future-Proofing: Key Negotiation Strategies

In fluctuating markets, addressing CAM charge considerations during lease negotiations is essential. Here are key strategies for future-proofing leases:

- Set Caps on Controllable Expenses: Limit annual increases for controllable expenses (e.g., maintenance, landscaping) to 3-5%, helping tenants manage costs predictably.

- Exclude Capital Improvements: Clearly specify which expenses are capital improvements and exclude them from CAM charges unless they lead to operational savings.

- Implement Audit Rights: Include a CAM audit clause to review detailed expenses, ensuring transparency and avoiding overcharges. Deloitte reports that 70% of tenants find discrepancies in CAM billing, making this a crucial safeguard.

- Negotiate a Base Year or Expense Stop: In modified gross leases, set a base year limit where landlords cover expenses up to a certain point, providing tenants with a clearer cost structure over time.

These proactive strategies protect tenants from unexpected costs. Springbord’s expertise in lease abstraction and CAM reconciliation ensures lease agreements align with business goals, aiding in informed decision-making and cost efficiency.

Conclusion

Understanding CAM charges is important for business owners to manage expenses effectively and avoid potential disputes in commercial leasing. From grasping the components of CAM charges to negotiating favorable lease terms and staying updated on market trends, a proactive approach can significantly impact a business’s financial health.

Springbord’s expertise in lease auditing, abstraction, and CAM reconciliation services can be your trusted partner in navigating the complexities of commercial leasing. Our dedicated team ensures transparency, compliance, and cost efficiency, aligning your lease agreements with your business goals.

Contact Springbord today to take control of your CAM charges and safeguard your bottom line.