Read time 5 min

Read time 5 minReal estate businesses frequently become overloaded with core responsibilities, leaving little room to manage accounts receivable efficiently. This critical function, essential for ensuring adequate funding, can be particularly challenging due to the industry’s complexity and the high volume of transactions. As a result, real estate companies face a strategic decision: should they manage accounts receivable in-house or outsource to a specialised partner?

Outsourcing accounts receivable offers numerous advantages that can significantly benefit real estate companies. By leveraging the expertise of professional service providers, companies can reduce errors, enhance efficiency, and realise substantial cost savings. According to industry data, companies that outsource their financial tasks can achieve up to a 30% reduction in operational costs and a 50% improvement in accuracy.

Outsourcing additionally facilitates better cash flow management. Reducing Days Sales Outstanding (DSO) and accelerating payments are possible with a committed team ensuring follow-ups and invoices are sent on time. Enhanced financial stability and growth are consequently supported.

Are you curious as to why outsourcing might be a better option for your business? Explore this blog to learn about the specifics and benefits of outsourcing your accounts receivable, and understand why so many businesses use it as a cash flow management tool.

We at Springbord recognise the particular difficulties that real estate firms confront. Our all-inclusive services for managing your accounts receivable are intended to improve cash flow, reduce risks, and streamline your financial operations. With our advanced technology and specialised knowledge, we ensure high accuracy and efficiency, allowing you to focus on your core business activities and drive growth.

Receivable Services in Real Estate

Services related to accounts receivable are vital for real estate companies because they have a direct effect on cash flow which is an essential component of financial management. Efficient management of receivables ensures liquidity and supports smooth business operations. These services in the real estate industry cover a variety of tasks associated with collecting payments from customers, including renters or buyers of real estate.

Key Real Estate Receivable Services

- Lease Collection: The timely collection of tenant rent payments is fundamental. Ensuring that rent is collected on schedule maintains steady cash flow and reduces the risk of financial shortfalls.

- Other debts to be paid: This includes additional charges beyond rent, such as parking fees, and various miscellaneous charges. Managing these receivables is crucial for comprehensive financial management.

- Lease Operations: Effective lease management involves administering lease conditions and making sure that both parties comply. This includes handling lease renewals, terminations, and any amendments to lease agreements.

- Invoices and bills: Issuing accurate bills for management fees, rent, and other related expenses is vital. Proper invoicing ensures clarity and reduces disputes, facilitating smoother transactions.

- Processing of Payment: Prompt handling and processing of payments and updating accounts as needed is essential for maintaining accurate financial records and ensuring timely availability of funds.

- Accounting Reconciliation: Ensuring that payments match the issued invoices and settling any differences is a key aspect of accounts receivable management. Regular reconciliation helps maintain financial integrity and trust.

- Escalation Administration: Timely communication of rental increases or escalations is important. Properly managing escalations ensures that all parties are aware of and agree to new payment terms, thereby avoiding conflicts.

Concerning receivables management, real estate companies confront particular difficulties that we at Springbord are aware of. Our comprehensive services are designed to enhance your financial management processes, ensuring timely collection, accurate invoicing, and efficient reconciliation. We manage all receivables seamlessly using our advanced technology and expertise, freeing you up to concentrate on your core business operations.

How Stability in Real Estate Is Enhanced by Efficient Receivable Management?

Effective receivable services management is not only necessary but also a competitive advantage in the real estate industry. Efficient receivable management ensures financial stability, enhances cash flow, and supports seamless operations. Let’s delve into the significance of effective receivable management through real-world examples.

The Impact of Mismanagement in Rent Collections

Let us consider a real estate company that has $100,000 per month in operating expenses. This company will have serious cash flow problems if the $30,000 rent is not collected. This shortfall can hinder its ability to meet its financial responsibilities like paying employees and maintaining properties. Consequently, delayed payments and cash flow mismatches can negatively impact service delivery, creating a ripple effect that affects the company’s overall performance.

Ineffective lease management challenges.

Ineffective lease administration may lead to confusion regarding payment obligations, resulting in missed or late payments. Tenants might not comply on time, for example, if the agreements are unclear about due dates or rent increases. This situation starts a vicious cycle of disputes and follow-ups that takes resources away from growth-oriented projects. Clear and precise lease management is essential to ensuring tenants understand their obligations, thereby minimizing delays and fostering smooth operations.

The Strategic Benefits of Effective Receivables Management

To keep one’s finances in good shape, real estate receivables must be managed well. Businesses can meet their financial obligations on time, cultivate favourable tenant relations, and improve overall business stability by guaranteeing a steady cash flow.

Real estate companies can concentrate on strategic expansion and operational excellence with effective receivable management.

Positive Aspects of Outsourcing Receivables for Real Estate

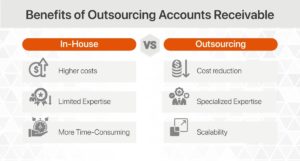

Real estate companies often face the decision of whether to manage in-house receivable services or to outsource them to partners that are specialized. Outsourcing has emerged as a strategic choice for many due to its numerous benefits.

Improved management of cash flow

Maintaining a healthy cash flow is dependent on the payment collection process, which outsourcing can greatly speed up. This is made possible by processing invoices quickly and following up on past-due payments, which guarantees steady and dependable cash flow.

Reduction Of Costs

Real estate companies that outsource can cut costs on salaries, benefits, and IT infrastructure—all of which are involved in keeping an internal team. This lower cost of outsourcing enables businesses to allocate resources more effectively.

Access to Specialized Expertise and Technology

Many real estate companies may not have access to the newest technology or specialized knowledge in accounts receivable management, which outsourcing firms frequently possess. Accuracy, adherence to modern financial procedures, and effective management of intricate receivables procedures are guaranteed by this experience.

Focus on the basic operations of the company.

Businesses can focus on their core competencies, like property management and customer relations, instead of administrative and financial operations, by outsourcing their receivables tasks. This focus can drive growth and improve service quality.

Flexibility and Scalability

With receivables services outsourcing, you can scale operations to meet your business needs without having to hire or train more employees. This is especially helpful for controlling workload variations across various business cycles.

Managing Risk and Ensuring Compliance

The risk of non-compliance and mistakes in financial processes is decreased because outsourced providers are skilled at navigating complicated credit situations and regulatory environments. This expertise aids in keeping correct records and preventing expensive errors.

Conclusion

Outsourcing accounts receivable management is a strategic choice among real estate companies, offering numerous benefits that enhance financial stability and operational efficiency. Real estate companies can lower expenses, increase cash flow, and concentrate on their main business operations by utilizing the knowledge and technology of specialized service providers.

Inefficient management of rent collections and lease agreements can lead to significant cash flow issues and operational disruptions. Conversely, effective management supports financial health and nurtures positive relationships with tenants, which are essential for business growth and stability.

Springbord recognises the unique challenges faced by real estate firms and offers comprehensive accounts receivable management services designed to enhance your financial processes. With advanced technology and industry expertise, Springbord ensures high accuracy and efficiency, allowing you to concentrate on your primary business functions and drive growth.

Are you ready to transform your accounts receivable management and drive your real estate business toward greater financial stability and growth? Don’t let receivable management challenges hold back your business’s growth.

Partner with Springbord to enhance your cash flow, reduce costs, and focus on your core business activities.