Read time 5 min

Read time 5 minProperty owners can generate substantial income from real estate, especially from rental income and property value growth, making it a valuable asset class. However, alongside these financial benefits come complex tax implications. Property taxes are one of the most substantial ongoing expenses associated with real estate ownership, and mismanagement can lead to costly penalties or missed savings opportunities. To maintain profitability and guarantee compliance with local regulations, property owners must have a thorough understanding of the complexities of real estate taxation.

This blog delves into the core elements of real estate taxation, exploring various types of property taxes, how they are calculated, and their impact on real estate investments.

At Springbord, we understand the challenges that come with managing property taxes and offer specialized real estate accounting services that streamline tax management, reduce errors, and ensure compliance with evolving regulations.

What are real estate taxes?

To pay for necessary public services like roads, schools, police, and fire departments, local governments impose property taxes. Unlike income taxes, which are based on earnings, property taxes are typically assessed on the fair market value of real estate assets. Annually, these taxes are levied; however, the frequency and amount may differ according to local laws.

Property taxes in the United States alone provided nearly $400 billion in funding for public schools in 2023. As a result, property taxes become a substantial source of income for counties, school districts, and municipalities. The money raised from property taxes is used to pay for a range of public needs that support community development and upkeep.

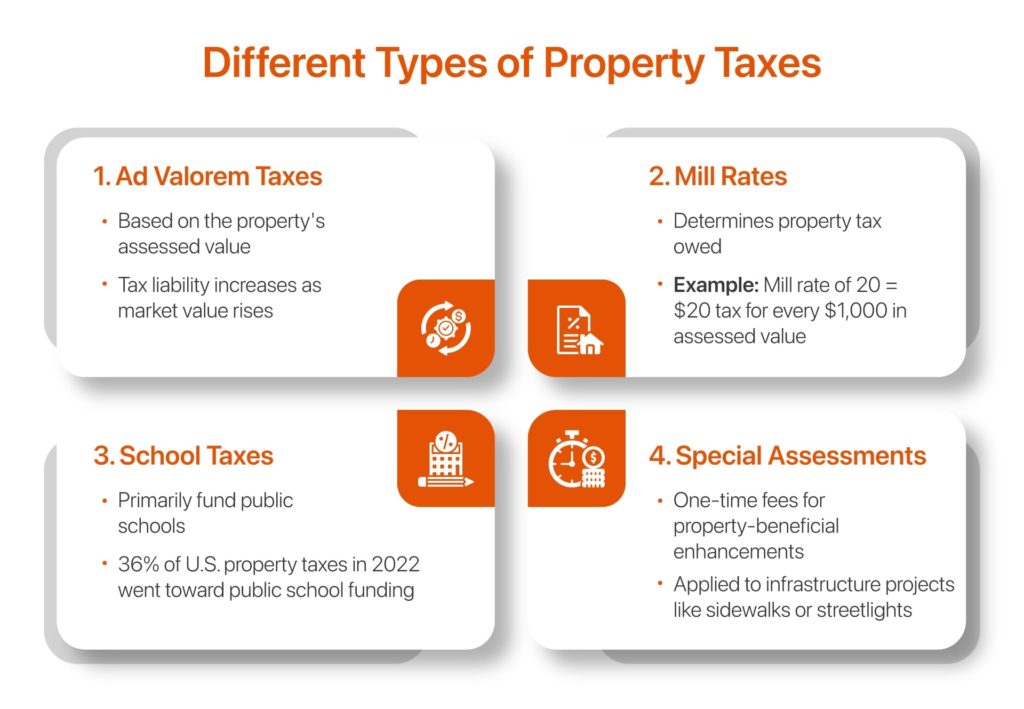

Different Types of Property Taxes

Different types of property taxes apply based on the jurisdiction, type of property, and usage. The main categories of property taxes that owners need to be aware of are listed below:

- Ad Valorem Taxes: The most common type of property tax, calculated based on the property’s assessed value. “Ad valorem” is Latin for “according to value,” meaning the tax liability increases as the property’s market value rises.

- Mill Rates: Mill rates determine the amount of property tax owed. A mill represents one-tenth of one cent, or $0.001. For instance, a mill rate of 20 indicates that the property owner must pay $20 in property taxes for every $1,000 in assessed value.

- School Taxes: Property taxes in many jurisdictions are set aside primarily to fund public schools. Property taxes are a significant part of the overall tax burden for property owners in the United States, with 36% of all property taxes paid in 2022 going directly toward funding public schools.

- Special Assessments: These are one-time fees assessed for particular property-beneficial enhancements, like the construction of new sidewalks. streetlights, or stormwater management systems. Unlike ad valorem taxes, special assessments are usually related to infrastructure improvements and can be significant depending on the project’s size and the property’s proximity to the improvement.

Springbord’s real estate accounting services include detailed tracking and categorization of various taxes, which helps property owners avoid overpayments and ensure accurate tax calculations.

The Calculation of Property Taxes

Property tax calculations can differ depending on jurisdiction but generally involve three important factors:

- Assessed Value: Determined by a property assessor based on the market value of the property.

- Mill Rate: The rate applied to the assessed value to determine the tax owed.

- Tax Base: The total value of all taxable property in the jurisdiction.

Formula:

Property Tax = Assessed Value / Tax Base × Mill Rate

For example, if a property is assessed at $300,000, the mill rate is 25, and the tax base is $5 billion, the property tax owed would be:

300,000 / 5,000,000,000 × 25 = $7,500

This formula illustrates how property tax liabilities are calculated and highlights the importance of accurately determining the assessed value and mill rate for each jurisdiction.

Springbord specializes in managing property tax calculations for clients, ensuring accurate assessments, and taking advantage of any available deductions.

The Intent of Property Taxes

The primary purpose of property taxes is to fund essential public services that benefit the local community, including:

- Education: Property taxes fund a large portion of public school budgets, which covers teacher salaries, school maintenance, and educational programs.

- Public Safety: Police and fire departments rely on property taxes to maintain their operations and respond to emergencies.

- Infrastructure: Roads, bridges, and public transportation systems are often financed through property taxes, ensuring safe and efficient transportation networks.

- Libraries, Parks, and Recreation: Public libraries, parks, and recreational facilities that contribute to community well-being are funded by property taxes.

At Springbord, we assist clients in making informed plans for the future by giving them thorough reports on the effects property taxes have on their investments.

Property Taxes and Investment in Real Estate

Property taxes have a significant impact on real estate investments, as they directly affect profitability and cash flow. When evaluating possible properties, investors need to make sure that property tax rates will not negatively impact their projected returns.

Property taxes vary not only by location but also by property type, with residential, commercial, and industrial properties often facing different tax treatment.

- Impact on Investment Returns: Property taxes can significantly reduce an investor’s net operating income (NOI). For example, in high-tax states like New Jersey, where the effective property tax rate on commercial properties exceeds 2% of the property’s assessed value, high tax burdens can substantially lower profitability.

- Varying Property Types: Different property types are subject to different tax rates and treatment. For example:

- Residential Properties: Some investors find these more appealing than commercial or industrial properties because they usually have lower tax rates.

- Commercial Properties: Commercial real estate often faces higher tax rates, especially in urban centers where the revenue potential is higher. Due to the substantial revenue these properties produce, local governments typically impose higher taxes on them.

- Industrial Properties: The tax rate on industrial property varies based on the nature of the business. While some jurisdictions impose higher taxes as a result of zoning and environmental regulations, others provide tax incentives to owners of industrial property to promote economic development.

- Tax Deductions: Property owners and investors may be eligible for a variety of tax deductions and credits, which can help mitigate the impact of property taxes.

Springbord helps real estate investors with tax forecasting, compliance, and financial modeling to reduce tax burdens and maximize returns.

Conclusion

For investors and property owners to stay profitable and in compliance with local laws, they must successfully navigate the complexities of real estate taxation. Property owners can make well-informed decisions that optimize their financial performance by being aware of the various kinds of property taxes, how they are computed, and how they affect ROI on investments.

Springbord offers expert tax management, financial modelling, and compliance solutions to help you reduce tax burdens and enhance investment success. To maximize your real estate tax plan, get in touch with us right now.