Read time 2 min

Read time 2 min

There are certain dates we fondly remember; still others we tend to forget despite trying hard to remember. But for all commercial real estate professionals, there are certain dates that will remain etched in their memory, thanks to FASB leasing standards taking effect soon.

There are certain dates we fondly remember; still others we tend to forget despite trying hard to remember. But for all commercial real estate professionals, there are certain dates that will remain etched in their memory, thanks to FASB leasing standards taking effect soon.

- If you’re a public company, the date is December 2018.

- If you’re a private company, it is December 2019 (for fiscal years beginning after that date) or December 15, 2020 (for interim periods within fiscal years beginning after that date)

According to the latest FASB standard, organizations that are lessees will have to recognize the assets and liabilities for the rights and obligations created by those leases on their balance sheets. The purpose of these new standards is to ensure better transparency and comparability among business organizations that lease equipment, buildings, and other assets.

What changed in FASB

Let’s simplify this. Long story short, the lease terms and balance sheets standards are going to change. If your lease is longer than a year (12 months), you are required to document the entire balance of lease payments as debts and assets.

FASB says there will be two types of leases going forward:

- One is consistent with the existing GAAP model (finance leases)

- One recognizes lease liabilities based on the outstanding lease payment values and corresponding lease assets (operating leases).

Where are you on the road to FASB compliance

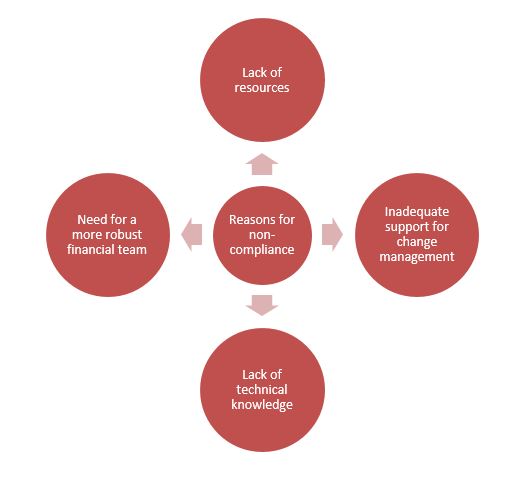

While the deadline for compliance with FASB is January 1, 2019, not all companies have done their due diligence. According to a KPMG survey, only 15% of companies have completed their implementations while another 45% indicated that they are in the process of implementing. In yet another survey conducted by EY, a whopping 71% of CFOs1 said their company’s efforts to become FASB-compliant are not yet complete. About 34% of CFOs are also concerned they will miss the FASB compliance deadline as they are either far behind the schedule or yet to start the drill. Are you prepared for the change? If not, what is stopping you from getting compliant?

Why are companies far behind on the curve

How to Achieve On-time Compliance

If you’re looking to become FASB compliant before the deadline looms in, follow these tips and achieve on-time compliance without any hassle.

Account for your assets

Sounds obvious but the new leasing standards require you to account for all the leases over a period of 12 months on the balance sheets as assets and liabilities and not just financial leases. So, when this hitherto off-balance sheet item is moved to the balance sheet, its amortization expenses will need to be accounted for in a company’s financial statements.

Put together a strong and robust internal team

The most successful projects are often driven by senior finance or accounting professionals capable of grasping the complexity and nuances of the project. When you have such skilled and experienced executive on your internal team, you benefit from the knowledge and authority of such internal resources and have full control of your business. Ideally this internal point person must also have a strong working knowledge of the ERP system.

Implement proper lease abstraction

First locate and understand all your leases thoroughly. You will most likely come across a diversity of data format and field names. Now ensure your process abstracts clean data into your brand new system. Incorrectly packaged data can cause you problems, says Fresenius’ Notar.

Find the best provider

Partner with auditors and software companies that are well versed with the new standards in your industry and can offer resources you can tap into for proven systems and processes. Contact Springbord today to find out how we can help you in achieving FASB compliance within the stipulated time.