Read time 6 min

Read time 6 minIn today’s business landscape, the ability to accurately manage and report lease transactions has become a crucial aspect of financial stewardship. With the introduction of new accounting standards like ASC 842 in the United States and IFRS 16 internationally, lease accounting has undergone significant changes aimed at enhancing transparency and comparability across financial statements.

To navigate these complexities, many businesses are turning to professional lease accounting services.

These changes, while beneficial for stakeholder clarity, pose unique challenges for companies, making it essential for business owners and financial professionals to stay vigilant and well-informed.

This blog will look at the critical aspects of lease accounting, common pitfalls to avoid, and best practices for ensuring compliance and strategic financial management, demonstrating how Springbord’s tailored financial services help clients with effective lease management and strategic decision-making.

Overview of Lease Accounting

Lease accounting involves the accurate recording and reporting of lease transactions on the financial statements of a company.

With the implementation of standards such as ASC 842 and IFRS 16, all leases, barring a few exceptions, must now be recognized on the balance sheet, providing a more comprehensive view of a company’s financial commitments.

Significance of Accurate Lease Accounting

The accuracy of lease accounting holds significant implications for a company’s financial health. According to Gartner, 78% of CFOs agree that accurate financial reporting is crucial for maintaining investor confidence.

Correct lease accounting practices ensure compliance with financial reporting standards and provide stakeholders with a transparent view of the financial obligations and assets of a company.

Inaccurate lease accounting can lead to significant financial restatements and mislead stakeholders about the company’s operational health and financial stability.

Implications of Errors in Lease Accounting

Errors in lease accounting can have far-reaching consequences. Misclassification of leases or incorrect measurement of lease liabilities and assets can distort a company’s financial ratios, such as its debt-to-equity ratio and interest coverage ratios.

Such distortions can affect a company’s credit rating, borrowing costs, and investor confidence. Additionally, inaccuracies can lead to non-compliance with financial regulations, resulting in penalties and damaged reputational trust.

By understanding the foundational elements of lease accounting, recognizing the common errors, and implementing By understanding the foundational elements of lease accounting, recognizing common errors, and implementing best practices, companies can better manage their lease obligations and make more informed financial decisions.

Springbord’s comprehensive real estate services, combined with high standards in lease accounting, demonstrate our commitment to financial integrity and transparency. These qualities are crucial for sustaining long-term business relationships and achieving strategic goals.

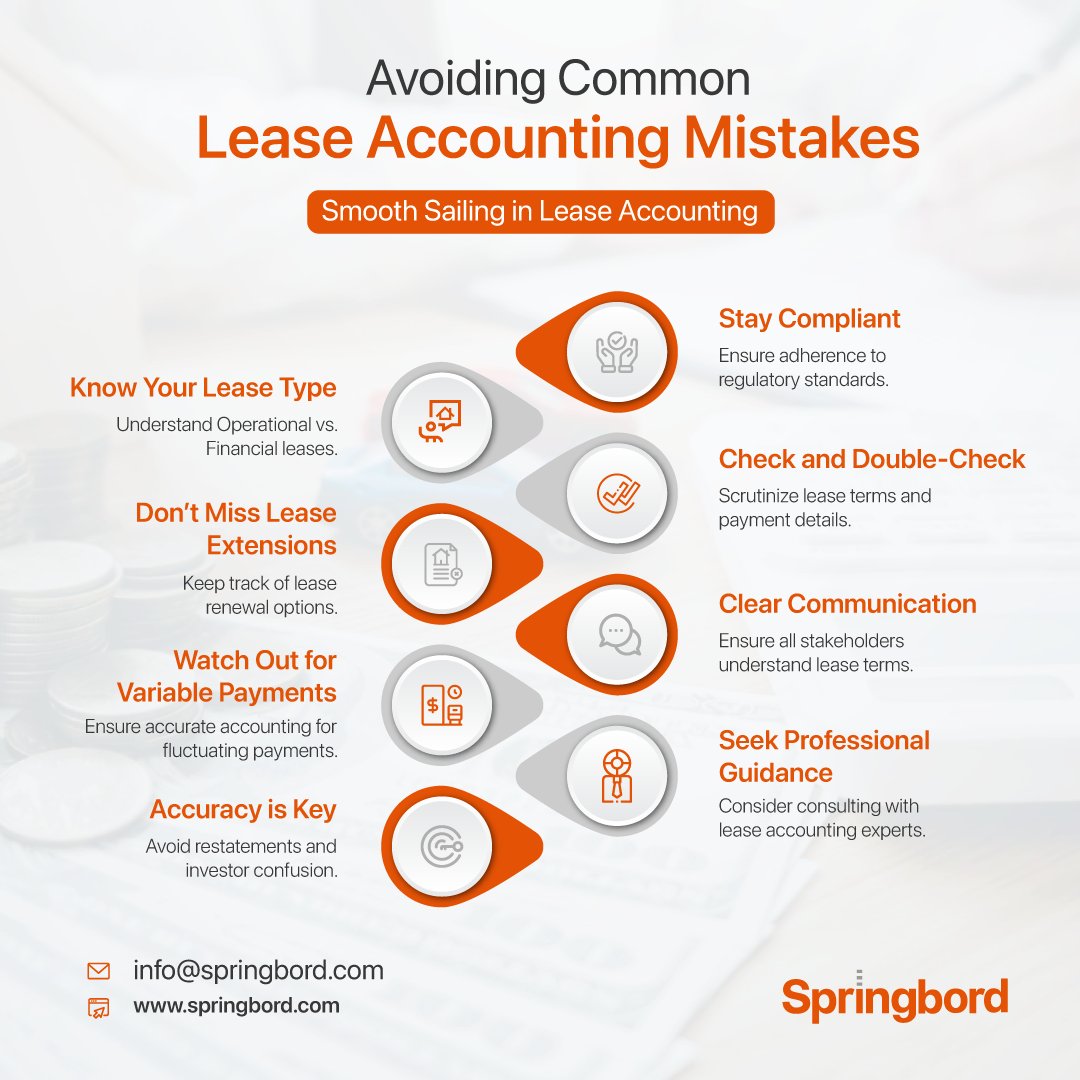

Common Pitfalls in Lease Accounting

In the world of financial reporting, accurate lease accounting is crucial due to its significant impact on an organization’s balance sheet and income statement.

These changes aim to provide a clearer picture of a company’s financial health by making lease obligations more visible. However, this shift also brings challenges that can lead to common pitfalls.

Misclassification of Leases: Operational vs. Financial

Misclassification of leases under standards like ASC 842 and IFRS 16 can significantly impact financial statements. Correctly classifying leases as either operational or financial is crucial because it determines how they are recorded. Financial leases, which transfer most ownership risks and rewards to the lessee, are recognized on the balance sheet as assets and liabilities.

Operational leases, traditionally off the balance sheet, are now also recognized due to recent standard changes. Misclassification often arises from misunderstandings of key criteria such as ownership transfer, lease term relative to asset life, and the present value of lease payments compared to asset value.

- Criteria for Classification and Common Misinterpretations:

The criteria distinguishing operational from financial leases impact how liabilities and expenses are recorded. A lease is financial if it involves a transfer of ownership by the lease’s end, offers a purchase option at a bargain price, spans most of the asset’s economic life, or if the present value of payments covers most of the asset’s fair value.

Misinterpretations of these criteria can lead to significant financial restatements.

Incorrect Lease Term Determination

Incorrect lease term determination significantly impacts lease classification and measurement, affecting financial reporting and compliance with standards like ASC 842 and IFRS 16.

The lease term should include the non-cancellable period and any options to extend or terminate the lease if there is reasonable certainty it will be exercised. Failing to accurately judge these options can lead to substantial discrepancies in reported assets and liabilities, influencing a company’s financial metrics and adherence to lease accounting standards.

- Inclusion of Renewal Options and Termination Clauses in Lease Term Calculations:

Properly determining the lease term is critical as it affects lease valuation and classification. It must consider all periods that are likely to be enforced under renewal or termination options.

Misestimating the probability of these options being exercised can cause significant measurement errors, impacting financial ratios and debt covenant compliance.

If you need assistance with lease term determination or other lease accounting challenges, contact Springbord today to learn how our expertise can help you navigate these complexities effectively

Failure to Account for Variable Lease Payments

Accounting for variable lease payments is a crucial aspect of lease accounting under standards like ASC 842 and IFRS 16. These payments, which fluctuate based on indices or rates such as the Consumer Price Index or market interest rates, must be accurately estimated at the start of the lease and adjusted with changes in the index or rate.

Mismanagement of these payments can lead to significant inaccuracies in the reported lease liabilities and expenses, affecting financial statements and a company’s compliance with lease accounting standards. It is essential for maintaining financial accuracy to regularly reassess and update these payments as economic indicators change.

- Handling Payments Dependent on Indexes or Rates:

Variable lease payments require ongoing attention to ensure that they are correctly estimated and recorded. Initial estimates must be made at lease commencement and must be revisited whenever the underlying index or rate changes.

Failing to do so can result in the misreporting of financial obligations, skewing an organization’s financial outlook and potentially leading to compliance issues.

Each of these pitfalls can significantly affect the accuracy of financial reporting and compliance with new lease accounting standards.

At Springbord, we help clients navigate these complexities, ensuring that their lease accounting practices are both compliant and optimized for their specific operational needs. Our expertise in lease accounting enables businesses to improve their financial analysis and decision-making, leveraging accurate and timely financial information.

Best Practices for Lease Accounting

In the realm of lease accounting, especially under the stringent guidelines of standards like ASC 842, adopting best practices is not just beneficial but essential for compliance and enhancing financial performance. Here are three critical practices to consider:

- Implementing Robust Internal Controls

To ensure accuracy and compliance in lease accounting, establishing robust internal controls is crucial. This includes designing controls that address the inherent risks associated with lease accounting, such as misstatements and misclassification.

Key considerations should involve entity-level controls, technology, pre-adoption planning, and regular reassessment of controls to adapt to new risks or changes in the business environment. Effective internal controls help manage the complexities of lease accounting by preventing and detecting errors throughout the accounting process.

- Utilizing Technology and Software Solutions

The adoption and integration of specialized lease accounting software can significantly streamline the management and reporting of leases. Technologies that support lease accounting not only automate the process but also enhance accuracy, with features that can manage calculations, generate reports, and maintain audit trails.

These tools are essential for reconciling data across different periods, auditing, and providing an audit trail which is critical for both internal reviews and compliance with external audit requirements. Implementing such solutions reduces the risk of errors and enhances efficiency, allowing financial teams to focus more on strategic objectives rather than manual accounting tasks.

- Regular Training and Updates on Changes in Lease Accounting Standards

Continual education and training on lease accounting standards and updates are vital for keeping the finance team informed and compliant. This includes regular updates on any changes to the ASC 842 or IFRS 16 standards and training sessions to understand these updates thoroughly.

By staying informed about lease accounting standards, companies can ensure that their accounting practices remain compliant and that their teams are prepared to handle the lease accounting effectively.

By integrating these practices, companies like Springbord can assist clients in navigating the complexities of lease accounting, ensuring compliance, and optimizing financial performance.

These measures not only support compliance but also align lease accounting operations with broader corporate strategies, contributing to overall business efficiency and profitability.

Conclusion

Mastering lease accounting in the current regulatory environment demands diligence and strategic foresight.

With standards such as ASC 842 and IFRS 16 reshaping how leases are accounted for, businesses must adopt rigorous internal controls, leverage advanced technology solutions, and ensure continuous professional development to stay compliant and accurate in their financial reporting.

At Springbord, we are dedicated to helping businesses navigate these complexities efficiently and effectively. Our tailored lease accounting solutions are designed to align with your specific operational needs, ensuring that your lease accounting practices not only meet compliance standards but also support strategic decision-making and financial integrity.

Ready to optimize your lease accounting practices and enhance your financial performance? Visit Springbord today to discover how our tailored financial services can support your business needs.