Read time 5 min

Read time 5 minEvery dollar matters in the fast-paced business world, and keeping profitability depends on controlling operating costs. One area that often goes unnoticed and unchecked is Common Area Maintenance (CAM) charges in commercial leases.

While these charges are intended to cover shared property expenses, many business owners are unknowingly overpaying due to errors, uncertain lease terms, or even intentional overcharges by landlords. These unnecessary expenses have the potential to have a big, long-term effect on your revenue.

This is where a CAM audit becomes not just beneficial, but essential. A CAM audit examines these charges in detail to find disparities, recover overpayments, and make sure you are not paying more than you should be. In this blog, we delve into why you should consider a CAM audit, how it can safeguard your financial interests, and the steps to effectively implement one for your business.

Common Area Maintenance (CAM) Charges

Common Area Maintenance (CAM) charges are an important component of commercial lease agreements, designed to cover the costs associated with the upkeep of shared spaces within a property. These charges typically include expenses such as landscaping, security, utilities, and general maintenance of common areas like lobbies, hallways, and parking lots.

For tenants, CAM charges represent a substantial portion of their operating expenses, and they are often calculated on a pro-rata basis, depending on the size of the leased space relative to the total property.

The Problem: Overpayment Risks

Despite their importance, CAM charges are often subject to discrepancies, leading many businesses to unknowingly overpay. Overpayment can occur due to a variety of reasons, such as vague lease language, errors in billing, or even intentional overcharges by landlords. For example, landlords might include non-CAM expenses or inflate certain costs under the CAM umbrella, leading to significant overcharges over time.

The impact of overpaying for CAM charges is particularly pronounced in high-rent areas, where businesses are already facing tight margins. Excessive CAM charges can erode profitability, reduce available cash for other essential operations, and ultimately weaken a company’s financial standing. According to industry reports, businesses that fail to audit their CAM charges could be losing thousands of dollars annually in unnecessary payments.

Given these risks, conducting a CAM audit becomes a strategic necessity for business owners. A thorough audit can identify discrepancies, recover overpayments, and ensure that CAM charges are accurate and justified. With our focus on thorough CAM audits, Springbord can protect your financial interests and streamline your lease management procedure.

Steps to Implementing a CAM Audit

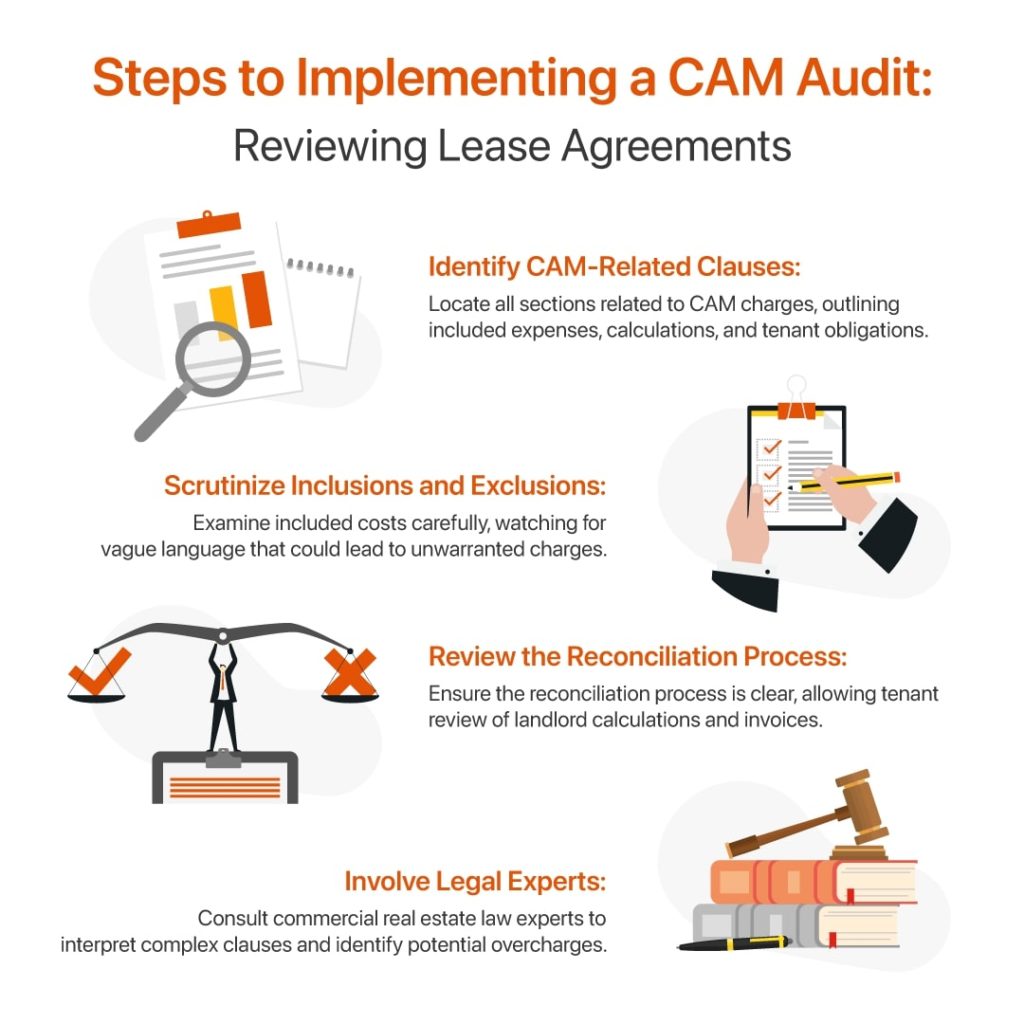

1. Reviewing Lease Agreements

Examining your lease agreements in detail is the first step towards comprehending Common Area Maintenance (CAM) fees. CAM charges are often detailed in complex legal language, which can obscure the true costs and responsibilities assigned to the tenant. Here are the key steps to effectively review your lease agreements:

- Identify CAM-Related Clauses: Start by locating all sections in the lease that pertain to CAM charges. These clauses will outline what expenses are included, how they are calculated, and the tenant’s obligations.

- Scrutinize Inclusions and Exclusions: Carefully examine what is included under CAM charges. Landlords may attempt to pass on costs that should not be considered CAM expenses, such as capital improvements or management fees. Particular attention should be paid to any vague language that might lead to a wide range of interpretations regarding acceptable charges.

- Review the Reconciliation Process: Most leases include a reconciliation process at the end of each year to adjust CAM charges based on actual expenses. Ensure that the process is clearly defined and that the tenant has the right to review the landlord’s calculations and the underlying invoices.

- Involve Legal Experts: Experts in commercial real estate law should be consulted due to the intricacy of lease language. These professionals can interpret complex clauses and identify potential areas of concern that could lead to overcharges.

By carefully going over your lease agreements, you can better understand what your CAM obligations are and spot any red flags that might need more research.

2. Engaging with Professional Auditors

Once potential issues have been identified in the lease agreement, the next step is to engage a professional CAM auditor. The process of hiring an auditor involves several considerations, including:

- Selecting the Right Auditor: Choose a professional with experience in CAM audits and a deep understanding of commercial lease agreements. Auditors should be familiar with the specificities of your industry and region to provide the most accurate analysis.

- Conducting the Audit: The CAM auditor will review the lease, examine all related expenses, and compare them against the charges billed by the landlord. This process involves detailed scrutiny of invoices, accounting records, and any relevant documentation to ensure accuracy.

- Cost-Benefit Analysis: While hiring a CAM auditor involves upfront costs, the potential savings can be substantial. A successful audit could result in significant refunds of overpaid charges as well as adjustments to future CAM payments. In many cases, the cost of the audit is outweighed by the savings generated, making it a valuable investment for businesses.

Engaging a professional auditor ensures that your CAM charges are thoroughly reviewed and any discrepancies are identified, providing peace of mind and financial savings.

3. Post-Audit Negotiations with Landlords

Following the completion of the CAM audit, it’s time to negotiate with your landlord to address any discrepancies found. Here’s how to go about taking this important action:

- Presenting the Findings: Start by presenting the audit findings to your landlord clearly and professionally. Provide detailed documentation of any discrepancies, along with your auditor’s analysis. This transparency will facilitate a more constructive discussion.

- Negotiating Adjustments: Be prepared to negotiate adjustments to both past overcharges and future CAM payments. This may involve requesting a refund for overpaid amounts or renegotiating the terms of your lease to prevent future discrepancies.

- Maintaining a Positive Relationship: While the negotiation process can be contentious, it’s important to maintain a positive landlord-tenant relationship. Approach the discussions with a collaborative mindset, aiming for a resolution that benefits both parties. A respectful and professional approach can lead to more favorable outcomes and ensure long-term cooperation.

- Legal Support: If negotiations become challenging, consider involving your legal counsel to assist in discussions. Throughout the negotiation process, legal experts can give you more negotiating power and guarantee that all of your rights are upheld.

Post-audit negotiations are an essential step in recovering overcharges and securing fair CAM charges moving forward. At Springbord, we are experts at assisting companies with this process and using our knowledge to get the best outcomes for our customers.

Conclusion

Effectively managing CAM charges is essential to protecting your company’s financial stability in the complex world of commercial real estate. Overpaying for CAM charges can deteriorate profitability and strain resources, particularly in high-rent areas where every dollar counts. By conducting a thorough CAM audit, you can identify discrepancies, recover overpayments, and ensure that your lease terms align with your actual expenses.

At Springbord, our team of experts is dedicated to helping you reveal hidden savings and negotiate fairer lease terms, ensuring your business remains financially strong and competitive.

Ready to secure your financial future? Contact Springbord today to learn more about our CAM audit services and how we can help you maximize your operational efficiency.