Read time 8 min

Read time 8 minIn property management, efficient accounting is essential to operational success because it helps managers make well-informed decisions, maximize investment returns, and guarantee regulatory compliance.

This blog explores the important facets of property management accounting, giving company owners who want to preserve cash flow and optimize profits a thorough understanding.

Property Management Accounting

Property management accounting encompasses the processes and systems used to manage the financial transactions and records of real estate properties.

Unlike general accounting, it requires a specialized approach to handle the unique aspects of property management, such as rent collection, maintenance costs, and lease agreements.

Key Financial Responsibilities of Property Managers

Property managers are responsible for several important financial tasks that call for exacting accounting practices, including:

- Rent Collection and Management: Efficiently managing rent collection processes to ensure timely payments and handling any issues related to late payments or defaults.

- Expense Tracking and Reporting: Keeping detailed records of all property-related expenses, including maintenance, utilities, and administrative costs, to manage budgets effectively.

- Financial Reporting: Generating comprehensive financial reports such as income statements, balance sheets, and cash flow statements to provide transparency and aid in strategic planning.

- Budgeting and Forecasting: Developing accurate budgets and forecasts to anticipate future financial needs and align them with operational goals.

Property managers may increase profitability, improve decision-making, and streamline their financial operations by utilizing sophisticated accounting software and upholding reliable financial processes.

1. Setting Up an Efficient Accounting System

Efficient accounting systems are pivotal for property managers to maintain financial stability, ensure compliance, and optimize operational performance.

Selecting the Right Accounting Software

Choosing the right accounting software is fundamental to building an efficient accounting system. Here are key features to look for:

Features to look for:

- Scalability: Ensure the software can grow with your business, accommodating more properties and transactions without compromising performance.

- Property-Specific Modules: Look for software that includes modules specifically designed for property management, such as tenant and lease tracking, maintenance scheduling, and rent collection.

- Integration Capabilities: The software should integrate seamlessly with other systems you use, such as CRM, banking, and payment processing platforms, to streamline operations and enhance data accuracy.

2. Chart of Accounts Customization

A well-structured chart of accounts (COA) is essential for effective property management accounting. The COA should be tailored to reflect the unique financial activities and reporting needs of property management.

Chart of Accounts to Property Management Needs:

- Income: Include categories for rental income, late fees, application fees, and other revenue sources specific to property management.

- Expenses: Track operating expenses (e.g., maintenance, utilities, property management fees) separately from capital expenditures (e.g., major renovations or upgrades).

- Liabilities: Include mortgage payments, loans, security deposits, and other liabilities.

- Assets: Track property assets, including buildings, land, and equipment.

- Equity: Reflect owner’s equity, retained earnings, and other equity accounts.

Customizing your chart of accounts to fit the specific needs of property management will provide clearer financial insights and facilitate more accurate reporting.

At Springbord, we are experts at implementing customized accounting programs for property managers.

Our expertise ensures that you have the necessary tools and frameworks to effectively manage your finances, allowing you to focus on maximizing your property investments.

If you have any questions or would like to learn more about our services, please reach out to us. We look forward to helping you succeed!

3. Recording and Tracking Income

Effective income tracking is important for property managers to maintain financial stability, ensure accurate financial reporting, and optimize revenue streams.

Rent Collection Processes

Ensuring timely and accurate rent collection is essential for maintaining cash flow and financial health.

Best Practices:

- Automated Payment Systems: Reduce late payments and administrative burdens.

- Tenant-Specific Records: Keep detailed records of each tenant’s payment history. BookingNinjas emphasizes specifying the tenant and documenting payment methods.

- Regular Reconciliation: Regularly reconcile rent payments with bank statements to ensure accuracy and identify discrepancies.

Handling Late Payments and Defaults:

- Clear Policies: Establish and communicate clear policies for late payments, including late fees and consequences.

- Automated Reminders: Send automated reminders to tenants before and after the due date.

- Enforcement: Follow procedures for enforcement, including legal action if necessary, while ensuring compliance with local laws.

Property managers can concentrate on streamlining their operations while Springbord takes care of the financial details thanks to our proficiency in monitoring rental income, managing late payments, and accounting for additional revenue streams.

4. Expense Management

Property managers must manage expenses effectively to maintain financial stability, identify cost-saving opportunities, and ensure accurate financial reporting.

Categorizing and Recording Expenses

Accurate categorization and recording of expenses are fundamental. Proper categorization facilitates better financial tracking and reporting.

Differentiating Between Operating Expenses and Capital Expenditures:

- Operating Expenses: Recurring costs for regular operations and maintenance, such as maintenance, utilities, property management fees, and property taxes.

- Capital Expenditures: Significant investments to improve or extend property life, like major renovations and equipment purchases. These are one-time costs that provide long-term benefits and are often depreciated over time.

Properly distinguishing these expenses is essential for accurate financial reporting and tax purposes. According to Buildium, maintaining an accurate chart of accounts is crucial for this differentiation.

Our speciality at Springbord is offering complete expense management services that are customized to meet the requirements of property managers.

Property managers can concentrate on making the most of their investments because of our expertise, which guarantees that all expenses are precisely tracked, categorized, and analyzed.

5. Financial Reporting and Compliance

Accurate financial reporting and adherence to regulatory requirements are essential for effective property management.

These practices not only ensure financial stability but also enhance transparency and compliance with legal standards.

Generating Accurate Financial Statements

Financial statements are the backbone of property management accounting, providing a clear picture of the financial health of properties.

Accurate financial reporting allows property managers to track income, manage expenses, and make informed decisions.

Key Financial Statements:

- Income Statement: This statement provides a summary of income and expenses over a specific period, typically monthly, quarterly, or annually. It helps property managers assess profitability and identify trends in revenue and expenditure.

- Example: The income statement for a property might show rental income, maintenance expenses, property management fees, and net profit for the period.

- Balance Sheet: A snapshot of the property’s financial position at a specific point in time. It includes assets, liabilities, and equity, providing insights into the overall financial stability of the property.

- Example: The balance sheet might list the property value, mortgage payable, and owner’s equity, showing the net worth of the property.

- Cash Flow Statement: This statement tracks the flow of cash in and out of the property, detailing operational cash flows, investment activities, and financing activities. It is crucial for managing liquidity and ensuring that the property has sufficient cash to meet its obligations.

- Example: A cash flow statement might show rental income received, payments for utilities and maintenance, and cash available at the end of the period.

Regular financial reporting is important for staying informed about the property’s financial status and making informed decisions.

According to Proalt, maintaining accurate depreciation schedules and generating reliable financial statements are vital for effective financial management in property management.

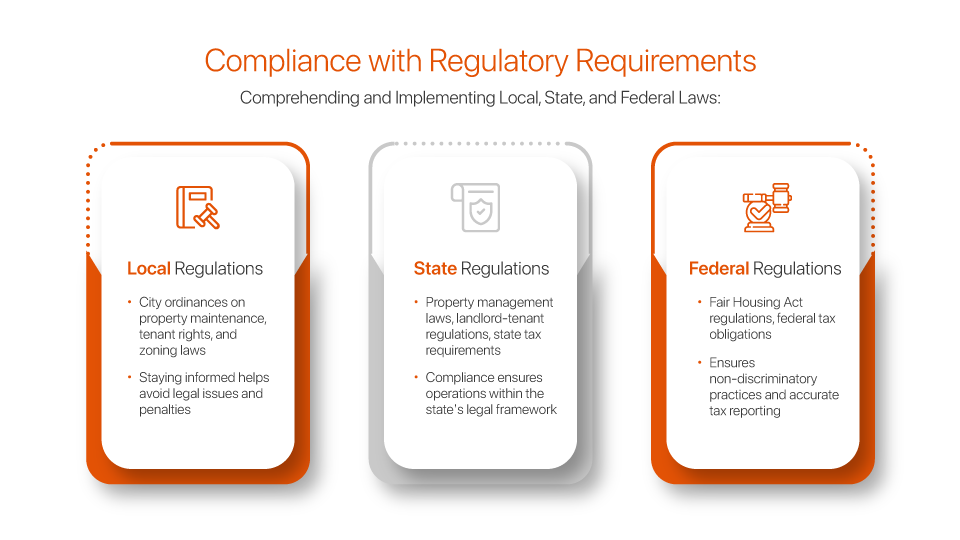

Compliance with Regulatory Requirements

Compliance with local, state, and federal regulations is a key responsibility for property managers.

Adhering to these regulations ensures that property operations remain lawful and that financial practices are transparent and accountable.

Comprehending and Implementing Local, State, and Federal Laws:

- Local Regulations: These may include city ordinances related to property maintenance, tenant rights, and zoning laws. Staying informed about local regulations helps property managers avoid legal issues and penalties.

- State Regulations: These typically involve broader property management laws, landlord-tenant regulations, and state tax requirements. Compliance ensures that property managers operate within the legal framework of the state.

- Federal Regulations: Federal laws, such as Fair Housing Act regulations and federal tax obligations, must be adhered to. These regulations ensure non-discriminatory practices and accurate tax reporting.

Compliance with regulatory requirements not only prevents legal issues but also enhances the credibility and reliability of financial reporting.

At Springbord, we specialize in providing comprehensive financial reporting and compliance services tailored to property management needs.

Our expertise ensures that property managers can focus on optimizing their operations while we handle the regulatory intricacies.

6. Budgeting and Forecasting

Budgeting and forecasting are essential practices in property management, providing a roadmap for financial planning and performance analysis.

These processes help property managers allocate resources effectively, anticipate future financial needs, and make informed decisions to optimize operations.

Developing a Property Management Budget

Creating a comprehensive property management budget involves several critical steps that ensure accuracy and reliability in financial planning.

Steps to Create a Comprehensive Budget:

- Forecasting Income and Expenses: Begin by estimating the expected income and expenses for the upcoming period. This involves analyzing historical data, market trends, and any anticipated changes in rental rates or operating costs. For instance, forecasting rental income would involve examining current lease agreements, expected occupancy rates, and potential rent increases.

- Gathering Historical Data: Utilize historical financial data to identify trends and patterns. This data provides a baseline for future projections and helps in setting realistic income and expense targets.

- Consulting Stakeholders: Engage with key stakeholders, including property owners, maintenance teams, and financial advisors, to gather insights and validate assumptions. Their input ensures that the budget reflects operational realities and strategic objectives.

- Using Budgeting Tools: Employ specialized property management software and financial tools to streamline the budgeting process.

At Springbord, we specialize in providing comprehensive budgeting and forecasting services tailored to property management needs.

Our expertise ensures that property managers have the insights and tools necessary to make informed financial decisions and optimize their operations.

Conclusion

Efficient accounting practices are crucial for property managers to ensure financial stability, compliance, and profitability.

By following the outlined steps, property managers can optimize their financial operations and make informed decisions that enhance their property investments.

At Springbord, we provide detailed accounting services for real estate that are customized to meet the particular requirements of property managers. Our expertise in financial reporting, compliance, budgeting, and expense management ensures that you can focus on maximizing your investments while we handle the financial intricacies.

Partner with Springbord to streamline your financial processes and achieve greater operational efficiency.